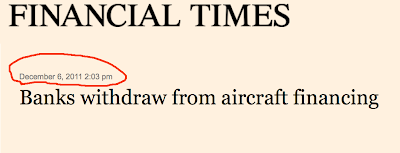

Yesterday, Reuters' blogger Felix Salmon in a well-written if somewhat verbose essay, makes the argument that "Greece has the upper hand" in its ongoing negotiations with the ad hoc and official group of creditors. It would be a great analysis if it wasn't for one minor detail. It is wrong. And while that in itself is hardly newsworthy, the fact that, as usual, its conclusion is built upon others' primary research and analysis, including that of the Wall Street Journal, merely reinforces the fact that there is little understanding in the mainstream media of what is actually going on behind the scenes in the Greek negotiations, and thus a comprehension of how prepack (for now) bankruptcy processes operate. Furthermore, since the Greek "case study" will have dramatic implications for not only other instances of sovereign default, many of which are already lining up especially in Europe, but for the sovereign bond market in general, this may be a good time to explain why not only does Greece not have the upper hand, but why an adverse outcome from the 11th hour discussions between the IIF, the ad hoc creditors, Greece, and the Troika, would have monumental consequences for the entire bond market in general.

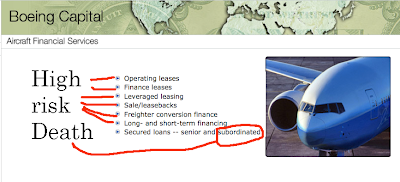

But before we proceed with the analysis, we should point out one minor nuance: Salmon, and thus the WSJ's Fidler, are correct that Greece has all the leverage in the world, in the same way that a suicidal person has all the leverage to take their own life as they stand on the ledge of a skyscraper. Because from a strategic standpoint, the reality is that over the past 2 years, the entire financial establishment has done everything in its power to mask the fact that Europe is currently undergoing a stealthy restructuring, without it actually being represented as a restructuring. The reason for this is that while an ex-event of default status quo allows the world's financial establishment to continue marking sovereign debt, even highly impaired one (remember: central planners are always right, markets - always wrong in pricing risk, or so the central planners say), at whatever prices it desires (recall that one of the very first things to happen in the post-Lehman collapse was the elimination of the Mark-to-Market statute, thus affording banks a plethora of gimmicks to mark 'assets' on their books at any valuation that excel spews out based simply on input assumptions, which in some cases are openly fraudulent), a case of sovereign default will very likely make mark to market unavoidable, thus exposing the proverbial nudity of the emperor. It also has implications for the ECB, for CDS triggers, and other consequences, but those are of secondary importance for the time being. Most importantly, the Nash Equilibrium at least until now, had afforded creditors, who in many cases have known very well that they have 'weak protections' on their sovereign holdings (more on this in a second), the myth that they are not subject to subordination, or seniority claims on their holdings, and thus the sovereign market was uniform, or pari passu. The outcome of the Greek negotiations, should Greece indeed use the "nuclear option" and force a coercive cramdown on any one, or all, bondholder classes, would do away with this myth in the blink of an eye, and instantaneously create a split between what will hence be perceived as senior and subordinated sovereign bonds. These are all considerations that the ECB, that European banks, and most importantly European sovereigns (and Greece) are all too aware of, and since the need to fund future deficits will only rise, any impairment of the sovereign funding apparatus is not only suicide for Greece, but for Europe, and eventually for the rest of the developed world.

Additionally Salmon ignores a simple tactical observation, one which the hedge funds are all too aware of, namely that while the bulk of Greek bonds are issued under Greek-law (a fact we first observed back in June, when we made the assessment of just who it is that really holds the reins in the default process) and while lacking collective action clauses, can be 'crammed down' retroactively, a smaller portion, which is estimated to be between €25 and €40 billion, has been issued under foreign, primarily UK-law, with strong creditor protection, and with Collective Action Clauses, which require that anywhere between 66% and 75% of all creditors agree to a given process, in this case the ongoing Greek prepack exchange offer (more later), for it to occur. It also means that bondholders in all other European countries are carefully watching if contract rights of "strong" UK-indentures are abrogated either in Greece or elsewhere, which would be a signal that there is no sovereign debt in circulation that is safe any longer from future attempts to strip positive and negative covenants, or explicitly stated bondholder rights. This is especially topical, as with Greece about to proceed with a prepack (non) bankruptcy, all eyes will turn to Portugal which is next, and after that Ireland, Spain and Italy. In this regard, what happens in Greece, under the advice of Cleary Gottlieb's Lee Buccheit, will be seen as a framework for all future bankruptcies that Europe will undergo.

And if Greece does proceed with what Salmon indicates is its "upper hand" course of action, what it will be doing, again going back to game theory, is defecting first, in the process forcing a broad sell off of weak, and potentially, strong indentures bonds of the other PIIGS nations, eventually leading to the collapse of demand for European paper, and the complete loss of confidence in the ECB, which has become a defacto source of equity for the PIIGS, an outcome which will eventually lead to the elimination of all funding for Greece itself. Which is why we said that Greece has as much leverage as one about to commit suicide... but at least it will be first - the line after it long and dignified.

Greek Bankruptcy 101

Before we get into the implications of what a scorched earth strategy by Greece would be, we would like to explain the process as it stands in Greece. Greece, has over the past nearly two years, been the functional equivalent of an insolvent corporation. The hundreds of billions in Troika bailout funding provided so generously to Greece is nothing but a prepetition Debtor in Possession (DIP) loan, with a first lien and collateral protection. The IMF may get paid back, but Greece will say goodbye to half its islands and historical monuments in the fire-sale that precedes. Furthermore, the ECB which as recently estimated by Barclays, has bought about €36 billion of Greek debt, is in effect a provider of equity financing. While this requires a tangential analysis, the ECB does not act as a Greek creditor, whose primary focus is to be repaid. No, the ECB would be more than happy to hold all the Greek debt, as it does not care one bit whether or not it gets paid interest - after all it can just print cash to fund its undercapitalized status should Greek bonds finally be recognized as worthless. If that were the case, Greece would be able to proceed with any debt transaction it desires, as any impairment at the ECB level would be promptly internalized, even if the ECB were to change its charter, which it probably very easily can, to make a Greek event of default a non-event from an accounting standpoint. Yes - the ECB's credibility will be greatly impaired, but how "credible" was it to begin with? Of course, Germany will hardly be pleased that Draghi is about to foot the bailout of an otherwise insolvent country, and monetize hundreds of billions; yet this would be spun that in doing so, the ECB would be assuring that continuation of the existing way of life... if only modestly longer. In short, this means that the ECB has been acting as a proxy debtor pari passu to Greece, even though it owns Greek debt. Said otherwise, the ECB has been conducting a quiet Greek debt-for-equity exchange, which would have had far greater success if, paradoxically, the market deterioration had persisted after the summer of 2010, when however the Fed proceeded with QE2, and stabilized credit markets (briefly). Of course: Europe can't devalue its currency alone - Bernanke will not be happy. The point is that if that ECB held all of the Greek sovereign debt, there would be absolutely no difficulties in getting the current "creditor" deal done as the ECB would have agreed to any terms. Especially since the ECB cares not one bit, if its Greek "equity" is impaired all the way to zero.

So we have a DIP lender, and we have continuing debt-for-equty (which has not converted nearly enough debt into equity). What is missing? Why an exchange offer and an actual fresh start balance sheet of course. Which is where the so-far-failing IIF negotiations come into play.

Here the moving pieces are most fluid, and the adversaries are Greek bondholders on one hand, primarily hedge funds who have bought Greek bonds in recent weeks and months and who seek as high a cash payout as is possible, and the IMF on the other, which is trying to make the "fresh start" Greek balance sheet as viable as possible. Because even at a 120% debt/GDP ratio post "reorg" it is hardly a leap of faith to assume that Greece will be insolvent again, and that quite quickly, especially with the country paralyzed by daily strikes, and where the deficit is now well into the double digits. At last check, the negotiations had stalled with private bondholders offered 30 year "post-petition" (said in gest - if Greece gets its agreement, there will be no actual bankruptcy petition, but for all intents and purposes there is) bond with a 4% coupon, which however, the FT just announced, would be cut to 3.5% on IMF demands, making the deal even less palatable for hedge funds. To sweeten the deal, the creditors would also be offered a 15% recovery on par in the form of short-term EFSF bonds, but no actual cash. We leave it up to our readers imagination what happens to the EFSF bond's price when all the Greek bondholders proceed to dump their allocations at the same time.

Needless to say, this is the stage where the leverage shifts from Greece to the creditors. Because while Greece and the IMF can demand that bondholders suffer 100% losses (even if that means a complete wipe out of Greek pension funds holding Greek bonds - a totally separate topic which we are confident the Greek media will have fun with on its own), exchange offers are never a sure thing, which is why it has never been branded as one for popular consumption, as failure would mean that the creditors have won and that a freefall bankruptcy is imminent.

This is also the stage where the broader media is confused (whether objectively so, or by representing the interests of conflicted hedge funds) as evidenced by the Reuters conclusion. The reality is that in order for an exchange offer to be binding, some majority of bondholders have to agree with the transaction. The problem is that the bulk of Greek bonds do not have what is known as a Collective Action Clause, or a framework which says what percentage of favorable votes is needed to enforce a decision, all have to agree. However, this opens the door for changing the rules. As Citi explained some time ago, "Greek law bonds have no Collective Action Clauses (CACs) which mean that voluntary restructurings require 100% of investors to accept the new terms in order to avoid triggering a default, an almost impossible hurdle." Which is why the Greek negotiation process implicitly requires the retroactive imposition of CAC, one which on one hand will facilitate the "exchange offer", yet on the other will create great distrust of any bonds issued under domestic law in other European countries.

Yet where the process falls squarely on its face, is the fact that Greece also has issued a modest amount, somewhere over €25 billion face, in bonds issued under UK-law. These are bonds which already have Collective Action Clauses and which as Stephen J. Choi and Mitu Gulati explain, come in two flavors: "Those that were issued prior to 2004 contained CACs that allow holders of 66% or more of an issue to modify payment terms in a manner that would bind all other holders. The bonds issued after 2004 require the consent of holders of 75% or more of an issue." Incidentally, this is where the Greece has the upper hand argument fails because while Greece can force local-law bondholders to do pretty much anything, it has no chance of doing that if a given hedge fund cartel has already built up a blocking stake in the UK-bonds. Choi and Gulati go on to state the obvious: "Obtaining approvals from between 66% and 75% of the bonds is likely to be difficult." And this is where the game gets interesting, because while the bulk of the bonds, or what is now becoming obvious is the junior class, can be impaired with impunity (pardon the pun), it is the UK-law, or the non-domestic indenture, bonds, which are the de facto fulcrum security. And since the notional outstanding here is tiny, it is quite easy to build up a blocking stake in the bonds and to obtain full control of the process, especially since the ECB appears to have been building up its own stake in local-law bonds.

Blocking Stake

As anyone who has ever overseen or participated in a bankruptcy process, the biggest trump card one can attain is to build up a blocking stake in a fulcrum security (just ask Carl Icahn) . Because it does not matter who has a majority. What matters is who has 33% + 1 of the vote to block any consensual deal. This is what is also known as "nuisance value" because in exchange for their votes, those blocking stake holders can demand anything, and be virtually assured of getting it, in order to allow the restructuring process to continue. This is precisely what the hedge fund hold outs, who started accumulating a block stake in the UK bonds some time in October, figured out in mid- to late-2011. And the fact that the ECB did not, back in 2010 when it was actively buying Greek bonds did not, only made it easier.

In a seminal paper by the IMF's Manmohan Singh titled "Recovery Rates from Distressed Debt -Empicial Evidence from Chapter 11 Filings, International Litigation, and Recent Sovereign Debt Restructurings", he does a far better job of explaining the holdout precedent than us:

Under the United States Bankruptcy Code, approval of a plan to reorganize requires the approval of two-thirds of each class of creditors. In response to this requirement, some vulture funds attempt to acquire more than one-third of a company's subordinated debt, with the object of blocking approval of the plan. By delaying the disbursement of funds to creditors, the holdouts exert pressure on senior unsecured holders to strike a deal rather than suffer further losses of time value of money. As a quid pro quo for their consent to the plan, the holders of a blocking position in the subordinated paper demand a larger percentage recovery than they would be entitled to under absolute priority.

And there is the entire Hedge Fund hold out strategy in a nutshell. Since as we already know the local-law bonds are in effect a junior class to the UK-bonds (and only senior to the ECB's bonds which are effectively a worthless equity tranche), the bargaining power of the process is now with the one or more hedge funds who control the UK-bond blocking stake. Because while Greece can force the local law bonds to agree to anything, and thus enact a coercive "cram down", it has no such control over UK-law bonds. At least not explicitly, but more on that in a second.

As it so happens, the bulk of the UK-law bonds have a 2016 maturity as the following Chart from Citigroup shows. In fact, of all vintages, this one is most evenly spread between Greek and UK-law.

![]()

So how does the active build up of a blocking stake look like from a pricing standpoint? It looks as follows: in this chart one can easily see the preferential accumulation of a UK-law bond over its less "protected" cousin in recent months as this strategy was being implemented by one or more hedge funds.

![]()

As can be seen the price for this preference is as high as 10 cents over the proposed "recovery" value for the entire bondholder class as a whole according to recent IIF leaks. Would one pay 43 cents for a bond unless there was something up their sleeve? Obviously not. Which brings us to a whole new topic of "sovereign litigation arbitrage" (prepare to hear this phrase much more in the future). But before we get there, there is one more open question: is it possible that the ECB does in fact hold the trump card, and can negate a blocking stake in the UK-bonds? Again we turn to Choi and Gulati:

The reason the ECB’s large debt holdings are important to the story is that the power to hold out is limited by the fact that, even in the English?law bonds, there exists a mechanism to quash the holdout. Specifically, a large enough fraction of the holders (between 66% and 75% of the bonds in principal amount) can collectively choose to cram down a restructuring on the holdouts. We do not know precisely what fraction of the various English?law bonds the ECB holds. But presumably it is a non?trivial amount, leading the bondholders who might be contemplating holding out, to be concerned that the ECB might use its votes to force a deal on them.

It may not be trivial, but it certainly is not sufficient. Because when one thinks that of the €25 billion in calculated face non-local bonds out there (of which some are non-UK law), the hold outs have to merely control a third plus one or just under €9 billion. At recent prices this is about €3 billion. A €3 billion investment to control the restructuring of a €240 billion (excluding the Troika's DIP loan) balance sheet? Not bad at all.

So now that we know more or less what the hedge fund strategy is, what happens if one does in fact assume that Greece has the upper hand, and that it is willing to proceed with terminal game theory defection and blast contract law into smithereens only to get a short-term respite?

First, as a reminder, here is how JP Morgan's Michael Cembalest described the potential next steps if indeed Europe proceeds with the scorched earth, aka, strip all UK-covenants, process.

Will Greece put “collective action clauses” (CAC) in place? Without getting too detailed, many Greek bonds were issued under language known as “universal consent”, which means that all creditors have to agree to changes to maturity, interest or principal. A CAC allows the issuer to obtain a plurality of support from bondholders for changes to the bond indenture, and then impose them on any holdout creditors. There’s nothing wrong with CACs, except for the fact that applying them retroactively changes the rules of the game, and makes a mockery of the quaint notion of contract law. As we explained in Appendix C in our 2012 Outlook, contract law protections for investors in sovereign debt are very weak. Don’t like retroactive CACs? Go sue in an Athens court; good luck to you.

A couple of points here: Cembalest is correct that those pursuing an Orphan Bond option (more on this later) will likely see an uphill climb. However, it is also true that as Singh points out, some of the best recoveries in all distressed work outs come precisely from orphan bonds. Litigation arbitrage gamesmanship aside, however, the JPM Pvt Wealth CIO has nothing to say about UK-bonds, because if the CACs of those indentures are stripped, and overriden with a new set of CACs, which is explicitly what would need to happen for a Greek pari passu fresh start bond market. then all bets are off, as it would mean that the very premise behind indenture protection is now at the mercy of lawmakers on a case by case basis. And just like MF Global being caught red handed commingling client funds was an event that crushed many investors' confidence in the stock market, so a strong-indenture cram down would have a comparable effect on the bond market.

Incidentally, here is Singh on Orphan Bonds and why they themselves can be so appetizing to distressed investors:

Distressed debt firms prefer holding illiquid debt to liquid debt since it is cheaper but carries legal rights identical to those of the relatively more expensive liquid debt. One example of illiquid claim is orphan bonds where the majority of a specific bond has either been extinguished via regular amortization prior to default or, has been given a new CUSIP' (identity) number following a debt exchange. For example, market sources indicate that Argentine orphan debt was keenly sought after the default and has already been bought by distressed debt accounts. Preliminary data from Bloomberg and market sources indicates that three main denominations of Argentine debt were sought after by distressed debt accounts. These were the 12.125 percent coupon 2019's, where about $102.5 million remained outstanding from the original $1.43 billion; the 10.25 percent coupon 2030's, where about $240.5 million remained outstanding from the original $1.25 billion; and the 12 percent coupon 2031's, where about $15.2 million remained outstanding from the original $1.175 billion. In this example, hold-outs have full payment in mind (including accrued interest) and with double digit coupons, interest arrears could be sizeable as the restructuring will most likely be protracted.

Prominent distressed debt accounts in the United States (WL Ross & Co, Oaktree, Cerberus, Angelo Gordon, or their affiliates) usually look for inexpensive claims, provided opportunities from the U.S. corporate distressed debt market do not "crowd out" investment into junk emerging market debt.

At this point it may be worthwhile to take a detour into...

Collective Action Clauses

While a staple in US corporate bond indentures for a long time, Collective Action Clauses (CACs) are a relatively new development in the sovereign bond market. Elmar Koch explains:

Collective action clauses (CACs) are a new element in the international financial architecture which is to ensure orderly and timely resolution of sovereign default. It was only in the summer of 2002 that a Working Group of the G10 was set up with the explicit aim of providing guidelines or a framework for the formulation of these clauses. The proposal by the Working Group gained wide currency with its endorsement by the G10 Finance Ministers and Governors in September 2002. At the same time, US private sector trade associations (“Gang of Seven”) also developed their own proposals for such clauses and there was IMF support throughout the whole period.

In February 2003 such clauses were for the first time included in a sovereign bond issue under New York (NY) law by a large major borrower, Mexico, and several other sovereign borrowers followed suit during 2003-04. By the beginning of 2004 it had become clear that key elements of CACs, in particular majority action clauses, had been included in this new bond documentation. This feature is expected to contribute to the more orderly resolution of sovereign debt crises by preventing unwarranted creditor holdouts.

Yet ironically, in the case of the Greek exchange offer, it is precisely these bonds that allow some form of plurality to be enforced and to override the government's attempt to enforce a unilateral decision of creditor stripping.

Continuing:

CACs are an integral part of the bond contract between a sovereign borrower and a private sector lender. These clauses become effective when and if a default of a sovereign borrower occurs. The vast economic literature coping with assessing the debt sustainability of a sovereign borrower is thus relevant. In the international context, a sovereign borrower may default on its bonded debt for a variety of reasons which reflect the ability and willingness to honour its debt obligations. From a legal perspective it is easy to claim pacta sunt servanda (contracts have to be honoured), but from a humanitarian/economic or political perspective a sovereign state may assess any debt payments quite differently. However, the CACs discussion usually assumes that the underlying sovereign debt at stake is deemed to be unsustainable.

From an international perspective it is desirable to aim at a resolution mechanism in debt restructuring that has the attributes of fairness (equity) to all parties and is orderly and timely. It should be noted that CACs are not concerned with the substance of the debt negotiation process itself but are primarily concerned with the process of the settlement of litigation within the legal system. Thus any agreement or settlement procedure (negotiation, mediation or arbitration that parties conclude outside the courts) may also be satisfactory and will not necessarily be covered by CACs. The contractual CACs were aimed at two emerging issues: the distribution of a large number of retail bondholders worldwide on the heels of a large credit appetite by some sovereigns, starting with the 1991-92 boom period, and the associated issue that some creditors will attempt to manipulate the process for their own benefit. More recently the emergence of in-fighting between creditors themselves in order to take a stab at assets of sovereign states first has emerged as a serious threat in upsetting orderly and timely restructuring.

The specifics of UK-law and "strong protections":

Traditionally, CACs were typically included in sovereign bonds governed by English, Japanese and Luxembourg law. Historically, such bonds issued under US, German, Italian or Swiss law did not include such clauses. The largest market for sovereign bonds is in the US, the State of New York. The adoption of CACs on the NY market was thus the key to providing an internationally acceptable level playing field (see Box 1). While Italy adopted CACs in 2003 under NY law, sovereign bonds issued under German and Swiss legislation last year were without CACs.

Yet even CACs still carry risks to sovereigns. So while the conventional wisdom is: "Good luck in Athens bankruptcy court", some eagerly desire precisely that option:

The wide interpretation of the pari passu clause in terms of pro rata sharing in settlement of the debt has the potential to unhinge CACs. No state will be able to make safe payments when these payments are transferred through another entity. Sequestration of such payments is possible.

Due to the above risks, markets have already been exploring new/other mechanisms to circumvent such risks by collateralising future flow receivables. The evaluation and effectiveness of such new instruments are beginning to be evaluated.

Sovereign bonds in the US do not include effective deterrents to bringing individual holder suits. These are included in UK-style trustee bonds but are not part of the fiscal structure. This appears to unhinge majority action clauses to some extent.

The immunity protection of sovereign states may be seen as a deterrent against individual legal proceedings. Yet, immunity protection itself may be at stake, as evidenced by the case of Italian bondholders vs Republic of Argentina. In these cases, CACs appear to be the unique suitable tool at the disposal of unpaid individual creditors.

There is much more in the literature on the topic of CAC and we point readers to Collective Action Clauses - The Way Forward for one of the best primers on what is sure to be a hotly contested issue as there are many more bonds in the European periphery and core which will be the object of precisely such analysis in the future, but for now we will simply point out that the main reason why CACs became such a hot topic in the early 2000s is because various hedge funds would sue countries for defaulting, and proceed to reap substantial windfalls after several years of litigation. The imposition of CACs was meant to halt this. And as noted above, the irony is that currently it is the CACs afforded to bondholders via UK-law, that is the focus of a potential cram down to keep the Greek debt exchange rolling along.

Yet the biggest concern once again, is that Greece does in fact go ahead and do something unprecedented, such as force all bondholders, not just the Greek-law ones, to be crammed down into a new issue. The chart below from Koch shows how many protections would immediately be rendered worthless, and why sovereign bondholders everywhere, not just those with local law indenture, but UK, are following all updates out of Athens very closely.

![]()

Before we, like Reuters and like JP Morgan, accept that even the local-law debt can be crammed down, we point readers to a seminal paper by none other than Lee Buchheit, the same one who is currently advising Greece on its bankruptcy negotiations (to call a spade a spade), called How To Restructure Greek Debt from May 2010, in which he says the following:

No country in Greece’s position would lightly consider a change of local law as an easy method of dealing with a sovereign debt crisis. The following factors, among others, counsel extreme caution before embarking on such a remedy.

- If done once, future investors will fear that it could be done again. The debtor country may therefore be compelled in future borrowings (in which international investor participation is sought) to specify a foreign law as the governing law of its debt instruments.

- A dramatic change in local law by one country might allow a worm of doubt to slip into the heads of capital market investors in other similarly-situated countries, driving up borrowing costs around the board.

- The official sector supporters of the debtor country will presumably balk at any action of this kind that could unleash the forces of contagion and instability upon other countries whose debt stocks also contain predominantly local law-governed instruments.

- The more dramatic or confiscatory the effect of the change of law, the higher the likelihood that it would be subject to a successful legal challenge.

And here is how Buccheit predicted precisely the weaknesses of the plan he himself is currently pushing for Greece, weaknesses which the hold out hedge funds are all too aware of:

In the case of Greece, such a challenge could come from three possible sources. The first is Article 17 of the Greek Constitution. That Article declares that no one shall be deprived of property “except for public benefit” and conditional upon payment of full compensation corresponding to the value of the expropriated property. The question, it seems to us (non-Greek lawyers that we are), is whether a mandatory alteration of the payment terms of a local law Greek bond in the context of a generalized debt restructuring could be said to impair the value of that bond; an instrument that, in the absence of a successful restructuring, would have in any event been highly impaired in value. Also of possible relevance may be Article 106 of the Greek Constitution which gives the State broad powers to “consolidate social peace and protect the general interest.”

A second source of possible legal concern might lie in the European Convention on Human Rights and its Protocols. Article 1 of Protocol No. 1 protects the right to the “peaceful enjoyment of possessions”. This right may be restricted only in the public interest and only through measures that do not impose an individual and excessive burden on the private party. That said, Article 15 of the Convention permits measures, otherwise inconsistent with the Convention, to deal with a “public emergency threatening the life of the nation”.

Finally, foreign holders of local law-governed Greek bonds subject to the Mopping-Up Law might look to Greece’s Bilateral Investment Treaties for redress. BITs protect against expropriation without compensation, as well as unfair and inequitable treatment. It appears that Greece has signed more than 40 BITs with bilateral partners.

Assuming some version of a Mopping-Up Law could survive any legal challenge, however, it could have significant tactical implications for a Greek debt restructuring. More than 90% of Greek bonds are governed by local law. If, to use our example, holders of 75% of all eligible bonds (local law and foreign law) were to support a restructuring, our version of a Mopping-Up Law should operate to ensure that more than 90% of the debt stock will be covered by the restructuring. The Mopping-Up Law would not affect holders of foreign law bonds. Participation by those holders would need to be encouraged by moral suasion and the use of contractual collective action clauses in the relevant bonds.

It certainly appears that not even the Greek law change is as much of a done deal as is widely expected. As for the foreign law bonds: good luck trying to impose moral suasion unless by moral, Buccheit of course means dollar-based. Because one thing that the world's best distressed hedge funds know, it is litigation. Especially sovereign debt litigation. And in the case of Greece, funds have already threatened to sue Greece if Greece proceeds to cram them down, supposedly on the local law bonds. Many in the media were quick to shut down this line of value extraction as a big waste of time. These same people would be wise to glance at least once at the following summary statistics on returns of distressed debt transactions involving international litigation from Manmohan Singh.

![]() Of all forms of distressed debt transactions, guess which one provides the greatest possible returns? Yup - international (sovereign debt) litigation. Still think they won't sue? Think again.

Of all forms of distressed debt transactions, guess which one provides the greatest possible returns? Yup - international (sovereign debt) litigation. Still think they won't sue? Think again.

Litigation Arbitrage

It appears that for many hedge funds, buying Greek debt (and ostensibly Portuguese, Irish, and so forth), at absolutely firesale prices, is one of two things: i) an attempt to build a blocking stake as discussed above, or ii) a means to generate an actionable adverse claim in international litigation (following a cram down or any other disputed subversion of creditor rights), which as shown previously, is on an annualized basis arguably the most profitable type of transaction ever. These are hedge funds, who are staffed to the brim with the highest caliber of international law and bankruptcy experts (many of whom have worked side by side with the likes of Buccheit), and who are versed in every nuance of all previous international bankruptcy case studies. In other words, in addition to litigation potential in case of a forced cram down, there are avenues open to litigation in the event of a 'simple' sovereign default.To wit, from Singh:

Investors attracted to this "exotic" debt market work often buy paper with the intent of suing for full recovery. These include Elliott Associates (earlier known as Water Street Bank and Trust) from the case of Elliott vs. Peru, and Dart from the Brazil Brady negotiations. Other investors that have recently engaged in such cases are: Cardinal vs. Yemen; Water Street Bank and Trust vs. Poland; Leucadia National Corporation and Van Eck vs. Nicaragua; Red Mountain vs. Democratic Republic of Congo. Most (but not all) investors have had successful litigation, or out-of-court settlements, or are holding favorable judgments/attachments on assets of the sovereign. They have averaged recovery rates of about 3 to 20 times their investment, equivalent to returns, net of legal fees, of 300 percent to 2000 percent. Litigation is a protracted process with many law suits taking 3-10 years to "settle." Legal documents on file indicate 6 years as a conservative median estimate for recovery, which suggests that annualized returns average 50 percent to 333 percent (Singh, 2002). Some of these claims were bought at roughly 10 percent of face value implying very high gross recovery rates. Subtracting legal costs, often recouped from the sovereign, these recovery rates are probably the highest in the distressed debt world. Creditor rights in most jurisdictions favor full recovery.

The bold-underlined sentence should put any concerns as to whether hedge funds will or will not sue Greece, Europe, the ECB and everyone else in the case of a cramdown and/or default to rest. And if the name Elliott appears among the list of Greek bondholders, consider it a done deal.

And speaking of suing the ECB, here our German readers may be delighted to know that in taking a gambit with hedge funds' litigation trigger finger, Greece is in fact exposing none other than the Bundesbank to litigation risk! Singh explains.

There is asymmetry between the Anglo-Saxon and continental European law regarding the nature of sovereign immunity. Starting with Foreign Sovereign Immunities Act of 1976 in the United States, a number of common law countries, particularly in the United States and the United Kingdom, have adopted legislation on sovereign immunity including protection from pre-judgment attachment of foreign central bank assets. In continental Europe, in contrast, foreign central banks are generally treated as entities separate from the foreign state. As a consequence the central banks assets enjoy little or no protection. The Deutsche Bundesbank, during the Cardinal vs. Yemen saga, considered amending the law (via Parliament) on the non- immunity provided to a sovereign whose assets are deposited with a German bank. However, the law on central bank immunity is not uniform in the major financial centers of the world. In continental Europe, there is no unified theory on central bank immunity. Central banks that are separately incorporated do not enjoy immunity, only the sovereign does. If litigation arbitrage continues, central bankers may avoid holding assets in places where there is no immunity.

We hope it is now becoming very clear why in addition to mark to market, the ECB is quite concerned about the status of its Greek bonds holdings. First, a quick reminder on the European TARGET 2 system, courtesy of Goldman:

![]() The ECB’s main role in the eyes of the general public is to set the interest rate level at which banks can borrow reserves at the ECB. Determining the appropriate stance of monetary policy is indeed the main task of the ECB in order to fulfil its “primary objective”, which the EU treaty defines as “to maintain price stability”.

The ECB’s main role in the eyes of the general public is to set the interest rate level at which banks can borrow reserves at the ECB. Determining the appropriate stance of monetary policy is indeed the main task of the ECB in order to fulfil its “primary objective”, which the EU treaty defines as “to maintain price stability”.

But the EU treaty also obliges the ECB “to promote the smooth operation of payment systems”, which implies “facilitating the circulation of money in a country or currency area”. The ECB plays a crucial role in the Euro-zone’s payments system through the so-called TARGET2 system, which allows banks to settle payments between each other. Around 866 credit institutions currently participate directly in TARGET2 and some 3,585 participate indirectly through subsidiaries. The daily average turnover of the system in 2010 was 343,380 payments, representing a total average value of €2.3trn.

One characteristic of the ECB’s TARGET system is that payments from one bank to another bank in a different Euro-zone country are processed through the respective national central banks. If, for example, money is transferred from country A to country B, this payment will involve the central bank of country A as well as the central bank of country B.

An important feature of the TARGET2 system is that claims among national central banks resulting from crossborder payments are not necessarily balanced. The payment from country A to country B therefore leaves, all else equal, central bank B with a claim vis-à-vis the central bank of country A. If the payments predominantly flow in one direction—always from A to B, without any offsetting flows—the receiving central banks’ claims will continue to rise, creating ever-growing imbalances in the TARGET2 system.

Thus, courtesy of TARGET 2, it may well be that German funds are exposed to Greek-related losses should the country default, and since as Singh explains the Buba could arguably be open to litigation on prejudgment attachment, is it fair to say that the risk-return of losing not only ECB credibility but also that of the far more tangible and respected Bundesbank, is likely not worth the cost of potential litigation? What we do know is that as we pointed out even before the MF Global fiasco's European hyper hypothecation connection was uncovered, the Bundesbank may "want out" of any future, and potentially current, claims exposure to the ECB. It remains to be seen just how much of a threat the litigation risk is to European central banks which are on the hook to a Greece default (i.e., all of them).

What is also known, is that the historical track record confirms that sovereign default litigation is not only not futile, but as already noted is among the most lucrative transaction types known to the buyside. Some case studies:

The Elliott vs. Peru case illustrates that payments in the clearing system can be interfered with in continental Europe. The Southern District Court of New York had ruled in favor of Elliott. Elliott had enforcement orders not only from Brussels (as is widely cited) but also from Luxembourg, the United States, the United Kingdom, Germany, and Canada. In Brussels, the court ruled that if any member of Euroclear accepts a payment from Peru, the court would impose a BEF100 million penalty on the member. As a result, Euroclear members (i.e., holders of restructured Peruvian debt) were reluctant to accept payment from Peru. This forced Peru to settle with Elliot. In 2001, a California (U.S.) court reiterated the Elliott verdict in Red Mountain vs. Democratic Republic of Congo (DRC), Kinshasa and ordered nonpayment to other creditors unless Red Mountain was paid pro-rata—and it was paid in June 2002. [ZH: more on the historic Elliott bv Peru case from "Moody's in How To Sue A Sovereign"]

Cardinal vs. Yemen reaffirmed that central bank immunity is not uniform throughout the major financial centers of the world. Germany's Bundesbank was aware of the international legal asymmetry that allows distressed funds, with prejudgment claims on a sovereign, to "shop" and seize assets in continental Europe. In this case, the plaintiff initiated proceedings on the merits in London where prejudgment attachment of the Yemeni Central Bank's assets was not possible under the U.K. Immunity Act. The plaintiff then obtained a prejudgment attachment of Yemeni Central Bank's assets in Frankfurt (where there was no jurisdiction) on the theory that the attachment was necessary to secure the rights of enforcement of the future English judgment, which in Germany would be recognized, pursuant to the Brussels Convention. This case was settled out of court in July, 2001.

Leucadia vs. Nicaragua is an ongoing case that highlights that central bank's assets are not immune in continental Europe. The lawsuit stems from the sovereign's incomplete buyback operation (under World Bank's International Development Association facility) in early 1990s. Many commercial creditors did not participate and have actively followed Leucadia's lead in taking Nicaragua to courts in the United States and the United Kingdom. Leucadia was awarded a favorable judgment in the Southern District court of New York in 1999 and tried to attach American and Continental Airlines payments to Nicaragua for flights to Managua. The Sovereign Immunity Act in the United States benefited Nicaragua prompting Leucadia to pursue attaching Nicaraguan assets in continental Europe. Currently, the sovereign is taking preventive measures by keeping all reserves in Basle, Switzerland, earning LIBID minus roughly 25 basis points. At least two other vulture funds (van Eck and GP Hemisphere) have rulings in their favor that allow them to attach Nicaraguan assets. [van Eck is a member of the Argentine Bondholder Committee].

In short, with recovery rates sufficient to make not one but two years of a hedge fund's returns in the case of successful sovereign debt litigation, our only question is where will Greece place on the below table, from the perspective of its creditors of course.

![]()

For many more litigation case studies, see Annex I in the full Manmohan Singh recovery analysis.

Needless to say, and contrary to conventional wisdom, the incentive for funds is to find a pretense to sue at all costs, so what Greece is doing is actually making the HF cartel's life that much easier, especially when Greek bonds can be bought at just over 20 cents on the dollar. Furthermore, one class of litigation we have yet to see is that of fraudulent conveyance against a provider of DIP financing in the case of a defaulted sovereign. Something tells us we will see just this in the case of Greece, as the bondholders allege that the IMF and the ECB, provided priority debt that crammed down existing claims, only to ultimately pull the rug from under the country, and thus dilute recoveries on both senior subordinated (UK-law) and junior subordinated (Domestic law) claims. Because if the bailout cash loses its superpriority status, the recovery waterfall for all claims suddenly looks far, far more attractive.

Yet all of these analyses may be very much moot, if Greece proceeds with the Plan Z scorched earth strategy, and crams down anyone and everything ratably, threats of lawsuits be damned and the structural complexities of actually enforcing such litigation, then we would really see the full market wrath in response to...

Sovereign Debt Subordination

What we present below is not our prediction of what will happen in the market. It is our view on how the market would react if Greece does in fact proceed with cramming down either the weak and the strong indenture, or just the former.

Potentially far more troubling than the consequences of a drawn out litigation in bankruptcy court, would be the market response of an implicit "foreign law" bond subordination, or the split of the bond tranche into senior and junior components. This is because according to a Bloomberg-sourced analysis run by Zero Hedge, while the local (weak) - non-local (strong) law analysis is relevant to Greece, if in asymmetric terms (with ~90% of all bond issued under Greek law), when one factors in the rest of the PIIGS, it suddenly becomes a very non-trivial bifurcation.

Based on Bloomberg data (using the GOVERNING_LAW mnemonic) in which clearly defined local law bonds are segregated from NA or non-local ones, the sovereign debt universe of the PIIGS, which amounts to €2.1 trillion, consists of €1.3 trillion in non-local law bonds, and a whopping €800 billion in local law bonds!

![]()

While not disclosing them here publicly, Zero Hedge is happy to discuss with its readers the CUSIP list of these two distinct bond sets. Because while quite a bit, if not nearly enough, has been said in the media about the two bond indenture classes in Greek bonds, absolutely nothing has been discussed about how this problem extends into the general periphery. Here, for the first time, we present it visually, by showing a matrix of bond price vs years to maturity for all five PIIGS. As expected, and as confirmed by the Choi and Gulati analysis, bonds with stronger protection (i.e. issued under non-local law) trade broadly richer than those without protection.

Italy:

![]()

Spain:

![]()

Portugal:

![]()

Ireland:

![]()

and Greece:

![]()

The kicker: if and when Greece proceeds with making a "mockery of the quaint notion of bondholder contract law", as Michael Cembalest so aptly put it, the spread between these two regression lines for every country, not just the PIIGS with their €2.1 trillion in debt, but every other one as well which offers creditors the option of dumping all weak protection bonds and jumping to the "strong" ones, will surge, as the realization that a very distinct class of sovereign debt has now been subordinated and that a senior and junior class of sovereign debt has emerged.

And since any incremental capital will further prime these bonds (good luck with that negative pledge covenant on the local law bonds) thereby acting as a DIP loan, in essence the sovereign debt structure is about to be trifurcated into secured, senior subordinated and junior subordinated bonds. Very soon nobody will trade corporates anymore as all legacy fixed incomes investors start doing "capital structure arbitrage" with the balance sheets of the likes of Italy.

How this will impact the sovereign bond market in the long run is anyone's guess, but it will hardly be positive. Especially when one considers that going forward even bonds issued under UK-law, should Greece attempt to strip these, will be percevied as insufficiently secure. Which means that the bond market going forward will no longer look at new sovereign bond issuance with the view that all bonds are created equal and have a pari passu standing, but that at any given moment one may be primed arbitrarily, or see any and all covenant protection stripped.

Before we proceed we would like to also point out one very curious Catch 22, in that if indeed Greece succeeds with its own exchange offer with the world not imploding, the natural next step would be for the other PIIGS to proceed with just such an exercise in order to cut their own debt load by up to 70%. Because while Greece may have the advantage, the question now become who will be second. Paradoxically, the more success this global strategy has, the deeper it sows the seeds of Europe's destruction, as more and more bondholders will actively shy away from all weak bonds first in the PIIGS, then in Europe, then in the world. Until at the end, there is no end-market demand, and the only buyer remains the central bank.

Finally, while we have no prediction of whether or not any of the above happens, one thing we are sure of: if the runaway central planners of the world believe they can legislate their way into an 'upper hand' over the bond market, in ever more desperate attempts to avoid the day of reckoning, they will fail without any shadow of a doubt. Because demand for risk comes first and foremost from a sense of stability, of fair and efficient markets, and equitability: something which has long been missing in the stock market, and which may very soon be taken away, by force, from the bond market as well.

Literature referenced in this analysis:

Pricing Terms in Sovereign Debt Contracts: A Greek Case Study with Implications for the European Crisis Resolution Mechanism; Stephen J. Choi, Mitu Gulati and Eric A. Posner

How to Restructure Greek Debt; Lee C. Buchheit, G. Mitu Gulati

Greek Debt; The Endgame Scenarios; Lee C. Buchheit, G. Mitu Gulati

Collective action clauses – the way forward; Elmar B Koch

Recovery Rates from Distressed Debt - Empirical Evidence from Chapter 11 Filings, International Litigation and Recent Sovereign Debt Restructuring; Manmohan Singh